What is a balanced scorecard? Debt to equity ratio Level balance ratio value

One of the characteristics of a stable position of an enterprise is its financial stability.

Below odds financial stability , characterize independence for each element of the enterprise’s assets and for property as a whole, making it possible to measure whether the company is financially stable enough.

The simplest financial stability ratios characterize the relationship between assets and liabilities as a whole, without taking into account their structure. The most important indicator of this group is autonomy coefficient(or financial independence, or concentration of equity in assets).

The stable financial position of an enterprise is the result of skillful management of the entire set of production and economic factors that determine the results of the enterprise. Financial stability is determined both by the stability of the economic environment within which the enterprise operates, and by the results of its functioning, its active and effective response to changes in internal and external factors.

The balanced scorecard is a specialized management system with which a company can accurately formulate its plans for the future, develop a strategy and subsequently translate it into reality.

What is this system for?

With the help of such a system, feedback is achieved between various internal business processes, as well as external indicators, which is required in order to increase strategic effectiveness and ultimately achieve appropriate results. When the balanced scorecard is fully implemented, strategic planning turns from a standard theoretical exercise into one of the most important areas of the enterprise. This increases the efficiency of the company and increases the stability of its work.

What is she?

As the developers themselves claim, the balanced scorecard provides support for traditional financial indicators, but it should be understood that they reflect only the course of future events, and also provide an adequate description for companies during industrial production for which investing in any long-term programs or in improving relationships with consumers was not nearly as significant as it is today. At the same time, such indicators are completely irrelevant when it comes to managing the activities of companies of the times information technology, who strive to achieve future results by investing in the experience of customers, employees, suppliers, innovation, technology and a wide variety of business processes.

It is for this reason that a balanced scorecard system was proposed, with the help of which it would be possible to supplement financial indicators with information that allows us to display customer satisfaction, internal business processes, as well as the possibility of company development.

What are its features?

This technology captures the company's key drivers, including customer service, financial and operational efficiency, as a whole set of different characteristics. The company can record and subsequently analyze these characteristics in order to understand whether strategic goals are actually being achieved in the process. A fully implemented system represents a consistent review of the company’s work at each level. Ultimately, each individual employee of the company processes a personal BSC (Balanced Scorecard) while trying to achieve their own personal goals. IN in this case employee is based on indicators related to corporate strategy.

Basics

The BSC (Balanced Scorecard) looks at a company from four perspectives and develops metrics, collects data, and analyzes them according to each perspective.

Development and learning perspective

This perspective includes thorough training of specialists, as well as the cultivation of a corporate culture not only on a personal level, but also at the corporate level. In a company where they actually work educated people, employees ultimately become the main resource.

IN modern conditions In environments with rapid technological change, knowledge workers must continually improve. Government organizations quite often do not have the opportunity to recruit new technically trained employees, and at the same time they also reduce the training of existing employees. This is the most important sign of brain drain from a company, and it is necessary in mandatory stop as soon as possible.

Certain indicators should ultimately fully demonstrate to the management team where exactly funds will need to be concentrated for detailed training of employees so that they bring the maximum possible benefit. In any case, development and training are the main foundation for the success of every truly progressive company.

Business Process Perspective

This perspective, as the name suggests, is directly related to internal business processes. From this perspective of strategy, the balanced scorecard provides managers with the ability to determine how effectively a company is performing and whether services and products meet the requirements of potential customers. Such indicators will need to be developed as carefully as possible only by those people who really accurately imagine business processes, that is, such work should not be performed even by the most professional outside consultants.

Customers' Perspective

The Balanced Scorecard from a customer perspective takes into account the increasing importance of customer focus as well as customer satisfaction. The main parameter in this case is that if customers remain dissatisfied, then they will simply start looking for other suppliers.

Poor performance in this area is a clear sign that the company is headed for decline in the future, even if at the moment the overall financial picture remains stable high level. In order to develop satisfaction indicators, it will be necessary to carefully analyze the types of processes and customers for whom certain types of services and products will need to be provided.

Financial perspective

The people who developed the enterprise balanced scorecard did not deny that traditional financial data could also be used. Providing timely and at the same time sufficiently clear information will always remain quite important, so managers should try to do as much as possible to ensure this.

However, in the vast majority of cases, the processing and maintenance of financial data is given much more attention than is really necessary. When implementing a corporate database, a considerable part of the work can and should be not only centralized, but also automated, and you must understand that a special focus on financial indicators leads to an unbalanced situation regarding other prospects. It is for this reason that additional financial data may also need to be considered, including risk assessment and cost-benefit data.

Management that is based on measurements

An organization's balanced scorecard builds on key concepts that are developed in previous management techniques such as total quality management, including:

- quality determined by the client;

- continuous improvement;

- expanding the powers of certain employees;

- the most important thing is to rely on control measurements as well as the use of feedback.

Dual-loop feedback

In the traditional industrial world, everything was subject to concepts such as “zero defects” and “quality control.” In order to be truly effective in protecting customers from defective products, significant measures will need to be taken in terms of inspection and testing on the production line.

The main problem with this approach is that the actual cause of the rejection may never be discovered, and there will always be some inefficiency in the rejection process. In particular, it was noted that at each individual production stage certain minor deviations may appear, the causes of which will need to be identified and recorded.

If these reasons can be fixed, then there is a way to reduce the number of defective products, and, accordingly, open up almost unlimited prospects for improving quality. For such progress, they are united by a balanced scorecard, an example of which can be seen in many modern companies, which has a feedback chain.

Why is this necessary?

The information will be further processed by managers in order to determine the causes of deviations in processes in which errors often appear. And after this, appropriate measures are taken to change the set of these processes. Just like a total control system, the development of a balanced scorecard involves feedback between various internal business processes and external results. But, in addition to this, it also provides an additional feedback ring, which combines the results of the business strategies used. Thus, the implementation of a balanced scorecard forms a double-loop feedback loop.

Resulting indicators

It is impossible to correct what cannot be measured, as a result of which indicators must be developed based on the priorities of the strategic plan, which contains key factors for business development, as well as criteria for selecting the most interesting characteristics for managers. A process for collecting information that describes these characteristics is then carefully designed and quantified for storage, display, and further analysis.

Decision makers evaluate the outcome of several measurable processes and strategies and monitor the results in order to ensure proper management of the company and provide feedback.

Therefore, in this case, the value of the parameters lies in the fact that they represent the basis that determines:

- Strategic feedback that demonstrates to decision makers the current status of the organization according to multiple perspectives.

- Diagnostic feedback to different processes in order to manage change.

- Temporal trends in changes in performance in accordance with the control measure.

- Feedback between measurement technologies, as well as the selection of monitored parameters.

- Quantitative input parameters for various modeling and forecasting techniques to be used in decision support systems.

Actual control

In this case, the main purpose of measuring is to enable managers to more clearly understand their own company's performance from multiple perspectives and therefore make wiser, longer-term decisions.

Modern business directly depends on how the processes of measuring and analyzing performance are carried out. Measurements in this case are based on the company's strategy and should provide critical information about key processes, outputs and final results. The information required to evaluate and improve performance can vary widely, including information about:

- clients;

- efficiency of service provision or product sales;

- market;

- operations;

- competitive comparisons;

- employees;

- suppliers;

- finances and expenses.

Analysis, which includes the Norton and Caplen Balanced Scorecard, uses information to determine projections, trends, causes and effects that would not be determined without its use. Data and analysis are essential tools for achieving a variety of company goals, including performance measurement, planning, improving operations, and comparing a company's performance to competitors or industry best practices.

The principle of balance is the principle of constructing any budgets. In accordance with Article 33 of the Budget Code of the Russian Federation, the principle of balance means that the volume of budgeted expenditures must correspond to the total volume of budget revenues and receipts from sources of financing its deficit, reduced by the amount of payments from the budget associated with sources of financing the budget deficit. Despite the clarity and logic of the theory of balance, achieving its practical implementation in budgets is associated with a number of problems. In this regard, the problem of imbalance is more often observed, which in turn manifests itself in budget deficits and surpluses.

Currently, there are a large number of methods and indicators characterizing budget balance, which are calculated using budget data. The main indicators of the budget of the Komi Republic, which are necessary for calculating the coefficients of balance and financial stability, are presented in table 2.

Table 2 - Main budget indicators of the Komi Republic, in millions of rubles

|

Name |

Deviation |

||

|

Total income, including |

|||

|

Tax |

|||

|

Non-tax |

|||

|

Free receipts |

|||

|

Subventions |

|||

|

Budget deficit |

|||

|

Own income |

|||

|

Own expenses |

In 2013, budget revenues of the Komi Republic amounted to 48.4 billion rubles, which is 4.5 billion rubles less than in 2012. As for budget expenses, it can be noted that their value increased by 3.7 billion rubles. The main reason for the increase in budget expenditures is the increase in wages for certain categories of employees of budgetary social institutions from July 1, 2013. In addition, in 2013, expenses increased to increase the state reserve of fuel and energy resources, to compensate for lost income to air, river and railway transport. The reduction in revenues and increase in expenses led to an increase in the budget deficit by 8.2 billion rubles, which in 2013 amounted to 11.5 billion rubles.

To analyze the balance and financial stability of the budget of the Komi Republic, the amounts of its own income and budget expenses were calculated, which are defined as the difference between budget income (expenses) and subventions. It is also necessary to calculate the following coefficients:

1) Budget coverage ratio = Income / Expenses

2) Budget autonomy coefficient = (Tax revenues + Non-tax revenues) / Own revenues

3) Subvention coefficient = Subsidies / Own income

4) Budget deficit coefficient = (Revenue - Expenses) / (Revenue - Gratuitous receipts)

5) Financial independence coefficient = Own income / Own expenses

6) Business activity coefficient = Non-tax revenues / (Tax revenues + Non-tax revenues)

7) Income per capita = Income / Population

8) Fiscal sufficiency ratio = Expenditures / Population

When calculating per capita income and the budgetary security ratio, we assume that the population of the Komi Republic in 2012 was 880,700 people, and in 2013 - 872,060 people.

The results of calculations of indicators of balance and financial stability of the budget of the Komi Republic are presented in Table 3.

Table 3 - Calculation of budget balance indicators

In 2013, the budget coverage ratio was 0.81, i.e. 81% of budget expenses are covered by revenues. Over the year, this figure decreased by 0.13.

The coefficient of budgetary autonomy, which shows the share of own income in the total amount of budget income of the republic, in 2013 was 0.89. Analyzing Table 4, one can notice that in relation to this coefficient there is a positive trend.

The subsidy coefficient in 2012 was 0.04, i.e. subsidies occupy 6% of the total volume of the republic’s own budget revenues. However, the value of this indicator in 2013 decreased by 2 times. This is due to a reduction in budget subsidies by 832 million rubles

The budget deficit coefficient of the Komi Republic in 2012 was 0.08. This value is within the limits of budget legislation, according to which the budget deficit of a constituent entity of the Russian Federation should not exceed 15% of the approved total annual budget revenues of a constituent entity of the Russian Federation, excluding the approved volume of gratuitous revenues. As for 2013, the budget deficit was 28%. As noted earlier, the sharp increase in the budget deficit of the Komi Republic is associated with a decrease in revenues received by the budget and an increase in budget expenditures.

The financial independence coefficient in 2013 was 0.80, which decreased by 0.14 compared to the previous year. This means that the republic can cover 80% of its own income on its own without the use of subventions.

The business activity ratio in 2013 was 0.88, which is 0.01 more than in 2012. This is due to the fact that the amount of tax and non-tax revenues decreased by 2,705 million rubles, despite the fact that this was 72% due to a decrease in tax revenues. The obtained coefficient value indicates that the share of tax revenues in the total amount of tax and non-tax revenues is 88%.

Per capita income in 2013 amounted to 54.97 thousand rubles of budget income per person, which is 5.13 thousand rubles less than in 2012. This reduction is associated with a significant decrease in the income of the Komi Republic.

As for the budgetary security ratio, or budget expenditures per capita, in 2013 they increased compared to 2012 and amounted to 68.8 thousand rubles per person (in 2012 - 63.87 thousand rubles). This change is associated with an increase in budget expenditures while a simultaneous reduction in the permanent population of the Komi Republic.

Having analyzed all the calculated indicators of balance and financial stability, we can conclude that the situation in the republic is deteriorating. This is evidenced by an increase in the budget deficit, a decrease in budget revenues per capita, an increase in the value of the budget sufficiency ratio, etc.

“UDC 393 DYNAMICS OF BALANCE IN FOREIGN TRADE RELATIONS OF THE REPUBLIC OF BELARUS AND THE RUSSIAN FEDERATION V.V. KOVALCHUK..."

ECONOMICS 103

BALANCE DYNAMICS

FOREIGN TRADE RELATIONS

REPUBLIC OF BELARUS

AND THE RUSSIAN FEDERATION

V.V. KOVALCHUK

Educational institution "Gomel State

University named after F. Skaryna", Republic of Belarus

L.P. BABASH

Educational institution "Belarusian Trade and Economic University of Consumer Cooperation", Gomel At the macroeconomic level, assessing the effectiveness of foreign trade activities is not a simple task, the solution of which is determined, first of all, by the choice of methodological approaches to this problem. Since the main indicators characterizing foreign trade relations at the macroeconomic level are exports, imports, balances and trade turnover (information support with these data is regulated by the Ministry of Statistics and Analysis of the Republic of Belarus), it would be advisable in modern conditions to apply a methodology for assessing the level of development of foreign trade activities based on the use of data indicators.

The methodology for assessing the level of development of foreign trade activity includes, in a broad sense, three interrelated stages. The first stage is an assessment of the balance between the foreign trade activities of the region (in this case, the republic) with trading partners; the second stage is an assessment of the effectiveness of the contribution of trading partners to the overall balance of the region and the third is a study of the level of development of foreign trade activities, including its diversification, for specific periods of time using a visual image, in order to optimize the structure of foreign trade relations of the republic.

The advantages of this technique are as follows: 1) the use of “dimensionless” indicators, i.e., not tied to a unit of measurement, which allows them to be compared with each other over different time periods; 2) availability of information support when using the necessary data in the calculations of indicators; 3) a real possibility of assessing the bilaterality of foreign trade relations, that is, when the assessment of export-import operations occurs simultaneously (existing performance indicators separately determine the effectiveness of either export or import operations).

According to this methodology, two indicators can be considered fundamental when analyzing the balance of export-import operations: the coefficient of balance of foreign trade activities and the efficiency of the contribution of the component (region).

The coefficient of balance of foreign trade activities is an estimated indicator of the level of development of the foreign economic activity of an enterprise and is calculated as follows:

VESTNIK GGTU IM. BY. SUKHOY No. 2 2002 K = C/TO, (1) where K is the coefficient of balance of foreign trade activities;

C – foreign trade balance;

TO – foreign trade turnover.

The coefficient of balance of foreign trade activities (hereinafter referred to as the coefficient) can take values ranging from “+1” to “–1”. When the export-import operations of an enterprise are balanced, the coefficient of balance of foreign trade activities approaches zero. If the volumes of exports and imports differ significantly from one another, then the value of the coefficient, depending on the sign of the foreign trade balance, approaches “+1” or “-1”. A coefficient value equal to “+ 1” or “- 1” indicates the complete one-sidedness of foreign trade relations, i.e. the foreign economic relations of the state are represented by either exports or imports. If the coefficient is equal to “0”, foreign trade relations can be considered completely balanced.

The value of the balance coefficient is calculated both to determine the balance of foreign trade relations with each partner participating in foreign economic activity, and to determine the overall balance with all foreign trade partners, based on the total balances and foreign trade turnover calculated for all regions.

The overall balance of foreign trade relations is influenced by each specific trading partner engaged in foreign economic relations.

The effectiveness of each partner’s contribution to the overall balance of foreign economic activity is calculated using formula 2:

ECi = Ki UDi, (2) where ECi is an indicator of the effectiveness of the contribution of the i-th foreign trade partner; Ki – coefficient of balance of foreign trade relations with the i-th partner; UDi – specific gravity foreign trade turnover with the i-th trading partner in the total foreign trade turnover.

The impact of the efficiency of the contribution of the i-th foreign trade partner on the overall balance can be determined using formula 3:

Ktot = EKi / 100, (3) where Ktot is the coefficient of the overall balance of foreign trade activities.

Analysis of the numerical values of formula 3 allows us to determine how each i-th foreign trade partner influences the overall balance of foreign economic activity.

The function of foreign trade activity is determined at the final stage of assessing the level of development of the foreign trade activity of the component. With its help, it is possible to clearly assess the scale of foreign trade operations in the region and identify changes in foreign trade activities at the regional level for a specific period. The function of foreign trade activity is determined as follows. Balance coefficients for the region's foreign trade activities and specific trade turnover with each trading partner are calculated. The values of balance coefficients are plotted on the x-axis, and the values of specific trade turnover are plotted on the ordinate axis. In this case, the area of change of the balance coefficient on the x-axis is in the range from –1 to + 1. Specific foreign trade turnovers are summarized based on their compliance with certain coefficient values.

The summation of ECONOMICS 105 is carried out if the region carries out foreign trade activities with a large number of countries, and, as a rule, at intervals, for example:

[- 1; 0.9], etc. The resulting total values are plotted along the positive value of the ordinate axis. Using the delayed points, a curve is constructed that determines the scale of foreign trade activity of the region for a specific period.

Analysis of the level of development of the region according to the function of foreign trade activity is based on the following main aspects. If most of the area limited by the curve is in the positive area of the x-axis, then there is an excess of export supplies over imports and the presence of a positive balance in the region. And vice versa: the presence of a negative balance in the region will show a larger volume of area limited by the curve in the negative area of the x-axis. The area corresponding to certain values of specific trade turnover located along the ordinate axis and located on the graph within the corresponding values of the balance coefficient will show the size of the volume of export-import transactions with specific participants in foreign trade activities. The plotting of a function graph is based on relative values, which makes it possible to compare the level of development of foreign trade relations of states over different periods of time.

Let us evaluate the foreign trade activities of the Republic of Belarus with the regions of the Russian Federation using the above methodology.

The Republic of Belarus carries out foreign trade relations with 7 federal districts of the Russian Federation: Central, Northwestern, Southern, Volga, Ural, Siberian and Far Eastern. Let us determine the balance of foreign trade relations of Belarus with each of these regions and the overall balance with Russia for 1999-2000, as well as the effectiveness of the contribution of each region of Russia and their impact on the overall balance of foreign trade relations between Belarus and Russia for each year under study.

Table 1 Data on the balance of foreign trade relations between Belarus and Russia in 1999

– – –

In 2000, with the deterioration of the balance of trade relations between the two states, the total volume of foreign trade turnover of Belarus and Russia increased significantly compared to 1999. It should be noted that with a fairly significant volume of trade turnover, the Central region has a highly balanced relationship with the Republic of Belarus (K = 0.054). The balance of trade relations between the republic and the North-Western region is almost at the same high level and the highest is with the Volga District (K = - 0.006). The greatest imbalance in relations remains between the republic and the Ural (K = -0.897) and Far Eastern (K = 0.6507) federal districts. The negative influence of the Ural region on the overall balance of relations between the Republic of Belarus and Russia in 2000 not only remained dominant, but also increased compared to the previous year (EC = – 24.21).

Thus, foreign trade relations between the Republic of Belarus and the Russian Federation for the period from 1999 to 2000. have the following features: First. The overall balance of relations between the Republic of Belarus and Russia during the period under study is quite high, although in 2000, compared to 1999, there were some trends toward a deterioration in the overall balance of their relations (K = -0.1979). Second. The overall balance of foreign trade relations between the Republic of Belarus and the Russian Federation during the period under study is most influenced by trade relations with the Ural region (EC has the highest value compared to other regions). At the same time, the volumes of import purchases from this region influence the formation of a negative balance in 1999-2000. Third.

Foreign trade relations of the Republic of Belarus with the Central region of Russia are characterized by the highest volumes of foreign trade turnover and a large degree of influence on the overall balance of relations between the two countries (in terms of contribution efficiency it ranks second after the Ural region).

As noted above, plotting the function of foreign trade activity is the final stage analysis, a kind of symbiosis of analytical research. The functions of foreign trade activities are defined for the period from 1999 to 2000, and each year has its own function. Graphs of functions of foreign trade activities are presented in one figure, which makes it possible to clearly demonstrate changes in the development of foreign trade activities of the Republic of Belarus in recent years.

– – –

Rice. 1. Graph of functions of foreign economic activity of the Republic of Belarus with the regions of Russia in 1999-2000 The graphs of functions presented in the figure clearly confirm the results of the analysis carried out at the previous stages when assessing the balance of the foreign trade activities of the republic. A graphical representation of the functions clearly shows that each of the two functions has two maxima. One of the maximums (let’s call it the first maximum) is located in an area close to zero, which indicates high volumes of foreign trade activity of the republic with its relative balance with the regions of Russia. Greatest influence Every year the Central Federal District, whose specific trade turnover fluctuates within 50%, influences the balance of foreign trade relations.

The second maximum of each function is located in the negative area in the interval close to unity on the x-axis (the area of significant import imbalance). The occurrence of this maximum is due to the annual large volumes of imports from the Ural region.

The analysis allows us to draw a conclusion about the need to further improve foreign trade relations with Russian Federation(first of all, establishing balanced relations with the Ural federal district), since VESTNIK GGTU IM. BY. SUKHOY No. 2 2002 At present, the advantages of the emerging common economic and customs space, the single market, which ensure the effective functioning of the existing scientific and production potential of our countries, have not yet been fully used.

Literature

1. Kovalchuk V.V. Analysis of foreign trade relations (transition period, regional aspect). – Mn.: Belinformprognoz, 1997. – 140 p.

2. Foreign trade RB 1995-2000: Statistical collection. – Mn.: Informstat of the Ministry of Statistics of the Republic of Belarus, 2001. – 374 p.

Received 09/05/2002

Similar works:

“THESES OF THE REPORT “On a set of measures to improve the investment climate and fulfill the 2014 targets for attracting investments” Speaker: Nechaev V.A., Deputy Governor of the Novgorod Region The primary task of the investment policy of the Novgorod region is the creation of legal, economic and organizational conditions that maximize strengthening the investment potential of the region and its effective use. In accordance with the instructions of the President..."

“VERKHOVNA RADA OF UKRAINE INFORMATION MANAGEMENT VERKHOVNA RADA OF UKRAINE AT THE MIRROR OF THE ZMI: For the information of others and the Internet ZMI, TV and radio broadcasts 24 April 2008, Wednesday DRUKOVAN 1st VIEW Budget excess Natalya Nepryakhina, Kommersant (Ukraine) The Verkhovna Rada yesterday accepted for consideration the revised The Cabinet of Ministers draft budget for 2009. As a result, contrary to the recommendations of the IMF and the personal position of the Minister of Finance V. Pinzenyk, a record deficit is planned for 2009...”

“Reflections on the book by M. Deryabin, horizontal economics: the contours of management (About the book by B. Milner and T. Orlova “Organizing the creation of innovations: horizontal connections and management”) The article examines the main provisions of the monograph by B. Z. Milner and T. M. Orlova. The prerequisites and main directions of development of network partner market coordination and corresponding methods of horizontal management are analyzed. Organizational management was considered...”

« article in the magazine http://publ.naukovedenie.ru Contact the editors: [email protected] UDC 339.137.22 08.00.05 Economics and management of the national economy Lednev Vladimir Alekseevich Moscow Financial and Industrial University “Synergy” Russia, Moscow First Vice-Rector, Scientific Director of the Faculty of Sports Management, Doctor...”

“World Economy Risks of public-private partnership in the innovation sphere of the Republic of Kazakhstan Current stage of development of the world economy stat. M. Mataev sets stringent requirements for states, compliance with which presupposes the presence of a system of intensively generated and implemented innovations. UDC 339.5 (574) BBK 65.428 Every year the innovation process becomes M-330 more intensive and more costly in relation to all types of resources. Therefore, the most effective..."

2016 www.site - “Free electronic library- Scientific publications"

The materials on this site are posted for informational purposes only, all rights belong to their authors.

If you do not agree that your material is posted on this site, please write to us, we will remove it within 1-2 business days.

The indicators of this group make it possible to determine the uniformity and balance of individual aspects of the insurance company’s activities. These indicators include:

1. The ratio of unearned premium to written insurance premium - is defined as follows:

The indicator serves to identify trends in the uniformity of insurance activities and reflect income from insurance.

2 Ratio of declared losses to paid losses.

This ratio allows us to determine the average period for loss regulation.

The next group of indicators allows us to determine the factors that had a decisive influence on the results of insurance activities.

This group of indicators includes indicators of factors that reflect the balance between the formation of the insurance fund and the expenditure of its funds to fulfill obligations to policyholders.

These are indicators of the level of payments.

1. Payment level indicators:

ð for life insurance - calculated as follows:

The indicator allows you to compare the costs of insurance payments and income received from life insurance in the period under review, and reflects the degree to which income from life insurance is sufficient to cover the costs of payments for this type of insurance activity. This indicator can be compared with the share of the net rate in the gross rate on life insurance, and an excess of the standard may be observed due to the presence of a part in insurance payments that should be covered by investment income. A negative trend is a significant increase in indicators (more than 10% per year).

ð for types of insurance other than life insurance, the indicator of the level of payments is calculated as follows:

![]()

The indicator allows you to compare the amount of expenses reflecting obligations to pay insurance compensation with the amount of income from insurance other than life insurance. The indicator can be compared with the average value of the share of the net rate in the gross rate. A negative quality factor is a significant excess of the share of the net rate over the value of the obtained indicator and the growth of the indicator (more than 10% per year).

The indicator of the level of payments for types of insurance other than life insurance is determined in general and taking into account the share of reinsurers:

The indicator is calculated to determine the effectiveness of the company's risk transfer operations in reinsurance. The indicator of the level of payments minus the share of reinsurers, exceeding the level of payments as a whole indicates the possible ineffectiveness of reinsurance protection.

ð when carrying out types of insurance other than life insurance and life insurance, the general indicator of the level of payments is calculated:

This indicator allows you to compare expenses reflecting obligations for insurance payments for insurance as a whole with the amount of income for all types of insurance provided by the company.

The results of insurance activities are also influenced by the level of expenditure of funds to cover the costs of running the business.

2 Indicators of the level of expenses for running a business

ð when carrying out only life insurance, or only types of insurance other than life insurance, the level of expenses for running the business is determined as follows:

The indicator serves to determine the share of business expenses (costs for concluding insurance contracts for management expenses) in the amount of income for the type of insurance activity in question. The indicator is compared with the average share of the load in the gross rate for life insurance, or for other types of insurance, non-life insurance. A significant excess of the obtained indicator over the value of the load share indicates an overexpenditure of funds that can be used to conduct business; a negative trend is a significant increase in the indicator (more than 10% per year).

When simultaneously carrying out life insurance and types of insurance other than life insurance, the indicator of the level of expenses by type of insurance activity is determined as follows:

Indicators of the level of costs of conducting a business are calculated as a whole and taking into account the participation of reinsurers. Indicators taking into account the participation of reinsurers are determined as follows:

Thus, indicators of the level of expenses minus the share of reinsurers serve to compare the costs of doing business, partially covered by commissions and bonuses for risks transferred to reinsurance, with the amount of income received from the types of insurance activities under consideration.

An additional indicator of the level of expenses is the trading form of the level of expenses for types of insurance other than life insurance:

This indicator reflects the level of business expenses in relation to sales volume and serves as an auxiliary tool for assessing the effectiveness of activities in the distribution of insurance products.

An additional indicator of the level of expenses is also the level of costs for concluding insurance contracts. The indicator is determined by type of insurance activity and is calculated as follows:

The indicator allows you to determine the level of spending of funds on concluding insurance contracts in relation to the received (accrued) insurance premium. This indicator can be compared with the standard share of commission in the gross rate. A negative factor is a significant excess of the standard, since it may imply an overestimation of the company’s costs for purchasing insurance contracts.

To analyze the relative size of losses settlement expenses, it is possible to use an indicator of the level of this type of expense, determined as follows:

The obtained value of the indicator is compared with the standard value of settlement costs included in the calculation of the reserve for declared but unresolved losses.

In order to determine the overall ratio of expenses and income for the company's insurance activities, a combined indicator of the level of expenses is calculated, showing the amount of expenses per 100 rubles of income. The combined indicator is determined by:

3 Combined indicator of the level of expenditure - calculated as follows:

ð when carrying out only life insurance

ð when carrying out only types of insurance other than life insurance

The level of other expenses is calculated as the ratio of changes in other technical reserves, contributions to the reserve for preventive measures and fire safety funds to the earned insurance premium.

When carrying out life insurance and other types, it is possible to calculate the combined indicator according to the following scheme:

The indicator allows you to compare the total amount of expenses for insurance activities with the amount of insurance income related to the period under review. A value of this indicator less than 100% indicates an excess of income from insurance activities over expenses. This indicator is calculated based on data on the overall insurance activities carried out by the company, and taking into account the participation of reinsurers. The excess of the value of the indicator calculated taking into account the participation of reinsurers over the value overall indicator may indicate the ineffectiveness of reinsurance protection.

It is used to compare the amounts of income from investment and insurance activities.

Nature calendars series “The world around us”

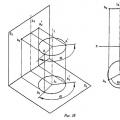

Nature calendars series “The world around us” Methods for converting a complex drawing Method for replacing projection planes

Methods for converting a complex drawing Method for replacing projection planes Why do you dream about a closet - interpretation of sleep

Why do you dream about a closet - interpretation of sleep