Find OKVED retail trade in building materials. Sample business plan for a building materials store. Purchasing the necessary equipment for a building materials store

Construction is one of the areas professional activity, which never stands still. Every year new materials and products appear on the market designed to improve the processes of building construction, repairs, etc. Naturally, trade in this industry must be strictly controlled, because otherwise negative economic phenomena may be observed - dumping, education shadow economy, monopolists and so on. In order to somehow cope with this task, in OKVED 2016, retail trade in building materials is divided into a large number of subsections. Of course, there are fewer of them than in the case of food products, but sometimes finding the right code is quite difficult. The reason for this, in addition to the variety of options presented, is the heterogeneity of this field of activity.

Few entrepreneurs are engaged exclusively in the trade of bricks or timber. As a rule, such organizations offer a wide range of products for any need, from the raw materials themselves to tools, fasteners and related products. In addition, specialty stores usually have their own delivery and other services. And they already belong to another section of OKVED. So it turns out that in order to organize a normal business in this industry, you need to spend a lot of time selecting a combination of codes that would fully reflect the essence of your activity. But we will not delve into the specifics, but simply consider the main types of goods that are included in the concept of retail trade in building materials.

Products and names by groups

Let’s say right away that the Federal Tax Service tried to somehow make life easier for distributors of this type of product by combining some similar products into one subsection. A striking example of this is “47. ", which contains:

- Trade in hardware.

- Glass products.

- Paint and varnish materials.

If your enterprise or store decides to sell just such a set at its points of sale, then you do not need to look for the code for each subtype separately. You can specify a general one, and that will be enough. If, for example, you sell glass and products made from it, but do not have paint names, then you will only have to enter subparagraph 47..3, and only if the sale is carried out in specialized stores.

This, by the way, is a separate topic that also requires attention. According to OKVED, retail trade in building materials can be carried out in almost any way. The most common option is specialized retail outlets, special construction stores, where you can find any product for repair and construction. However, there is an alternative in the form of all kinds of stalls at the market, stands in trading floors, trading through specialized Internet resources, etc. Many people simply want to maintain a warehouse with products and not have anything to do with the actual sale, doing only hot and cold calls and sending their goods through transport services. But it is worth remembering that in this case a completely different group of codes from the All-Russian Classifier of Economic Activities applies. And if you do not indicate them, and the tax office records the fact of sending and receiving money for this, you face a serious fine and other sanctions. So, first decide on the method of trading and its tools that you will use, and only then register a new entity.

Other types of goods

The construction sector also includes other products: bricks, concrete blocks, timber, cellulose, metal and non-metallic structures, finished wooden products. You can also think about various solutions, sealants, connectors, solvents, etc. Accordingly, for each item, the 2016 edition of OKVED has its own codes, which you must indicate during registration if you intend to retail the above products.

Some difficulties and features

Market building materials very heterogeneous and changeable. Due to the serious pace of global progress in this area, new types of products appear on store shelves, construction markets and other specialized places almost every day. Therefore, it is almost impossible to track and predict what your company will trade in a year. The only way out is to simply determine the direction and stick to this vector of development.

And in order to minimize contacts with government control authorities in the future and, at least for the near future after opening, forget about filling out official documents, before going through the registration procedure, prepare for this process. Find the OKVED database on the Internet, and in it section 47. under the letter “G". This is where the codes you need are located. You will have to sit for some time to find and record the necessary ones, but at the end of this operation you will have a powerful tool and all the necessary information to correctly fill out the forms required for registration.

In 2020, the latest amendment was made to the OKVED code. Thanks to this, editions 1 and 1.1 will be canceled this year, and the appearance of the second edition is completely different from the previous ones, which introduces some difficulties in the preparation of documentation among entrepreneurs.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

The All-Russian Classifier of Types of Economic Activities is part of the activities of each individual enterprise, company or organization.

This classifier allows, relatively speaking, to divide companies in accordance with the focus of their services.

Such a system helps to quickly learn about the goods or services provided by the company, as well as determine the main and additional directions and activities.

In fact, OKVED is the main source of information about the company and its legal activity. Until 2015, the first version of the classifier was in effect in the Russian Federation.

In 2014, the department decided to make some amendments to this issue and the matter was moving towards changing the code in 2014, however

OKVED-2 came into force only in 2015 and is valid until today. A code assigned to a title associated with the revision number included in it. Before this, there were codes 1 and 1.1, which are still valid until this time.

However, amendments to the old versions of the 2014 classifier should entail the cancellation of their functioning and recognition only new version code called OKVED-2. Operation old version will be filmed this year, 2020.

General points

There are a number of basic points related to the OKVED system that you need to know:

| OKVED is a system | Allowing classification of the activities of companies, organizations, individual and private enterprises |

| The foundation for the creation of the system was the system of the European Union (hereinafter referred to as the EU) | Which is called “Statistical classification of economic activities in the EU”, also considered a catalog of enterprises that classifies them according to their type of activity |

| Contains 21 sections | Under the name of each letter of the alphabet respectively. Each section is responsible for a separate branch of activity. Each of them also presents a different number of serial numbers, which are responsible for the name of the group of this branch, that is, for its branch. For example, section A is called “Agriculture and forestry, hunting, fishing and fish farming” and contains groups 01, 02 and 03 with the names “Crop and Livestock Production”, “Forestry and Sawmills” and “Fishing”, respectively. You can see the full table of sections and groups with a breakdown of codes and names below |

| Each group from the section has more than one serial number | However, the main table shows only the basic names. Each group with its serial number has a number of sub-items, which include narrowing the activity and assigning a code to each subgroup, up to a six-digit one |

What is it

The All-Russian Classifier of Types of Economic Activities (hereinafter referred to as OKVED) is nothing more than one of the documents from the set of documents of all-Russian classifiers of technical, economic and social information.

OKVED must be assigned to each opened company, organization or individual enterprise for their documents to fully enter into legal force.

The classifier divides organizations according to their activities. The activity itself, according to this system, is divided into:

- The main one.

- Additional.

The main activity is the occupation in which the enterprise specializes and in which it, according to its design, should surpass other companies competing with it.

An example would be a car dealership. Such an institution chooses the sale of cars as its main activity.

Accordingly, additional activities represent an occupation and provision of services in which an open institution does not specialize.

For example, a car dealership does not always provide repairs, washing or insurance for cars. Also, the salon is not obliged to sell auto parts, automotive parts, components and accessories.

And because its owners can choose any of this as an additional activity. Which will mean that the salon also provides the above services, but they are not aimed at the main audience attracted for sales.

What is his role

The role of the classifier can be reduced to several points, which were the purpose of its creation and the introduction of three editions:

- Classification of organizations, private and individual enterprises and firms of any organizational and legal form according to the type of their activity.

- Assigning a separate code to each type of activity.

- Regulation of this activity.

- Monitoring companies.

- Going international.

- Informing higher authorities.

Regulatory framework

It is necessary to strictly monitor the compliance of the company’s documentation with current legislation.

Getting a code according to the classifier is not the most basic step in entering into legal rights and opening an organization, company or individual enterprise.

It is important to remember a few points:

| Licensing | There are types of activities for which you need to obtain a license. IN in this case, even if you receive a classifier code and correctly complete all documentation, the company’s actions will be considered illegal. Therefore, it is necessary to familiarize yourself with the list of activities that require a license and obtain them before opening an enterprise. Receiving a code does not mean obtaining permission to operate, but only recording its existence |

| Organizational and legal form of a legal entity | This definition refers to the name under which your company will be officially registered, since this stage is one of the most important at the moment the organization enters into its legal rights. The fact is that each company must be harmoniously compared with its type of activity and official status. For example, a company of auditors will not become a closed company of shareholders |

OKVED code in retail trade

Starting this year, versions 1 and 1.1 lose their legal force and are no longer valid in the Russian Federation. Accordingly, each company must replace its activity code.

You don't need any special effort, you just need to contact the appropriate organization and reissue the document regarding the opening of a company and assigning it an activity code in a certain industry.

If this is not done, the company will be listed as a completely different group with a different focus, which will lead to law enforcement agencies to the idea of illegal activity during inspection.

Video: OKVEDs how many and which ones to choose

For example, the former retail trade code is 52. It also has a number of subparagraphs. However, according to the second edition, in honor of which the serial number was assigned to the current classifier, this industry has code 47 and the corresponding subparagraphs up to 47.99.5.

OKVED in this industry makes it possible to regulate the activities of official organizations of various sizes: specialized and non-specialized stores, kiosks, stalls, tents, as well as sales at home, handing over goods in person, courier delivery, delivery by mail, etc.

Main activities

The main types of activities that appear in the classifier are reduced to the names of the sections, namely:

- Agriculture and forestry.

- Minerals.

- Processing production.

- Electrical energy, gas, steam.

- Water supply, environmental cleanup.

- Construction.

- Trade.

- Transportation and saving.

- Hotels and restaurants.

- Publishing, cinema, Internet communications, telecommunications.

- Finance.

- Real estate.

- Science and technology.

- Military activities.

- Education.

- Medicine.

- Culture.

- Sport.

- Social organizations.

- Farms.

- Extraterritorial companies.

Table with transcript

The table shows the section, group code related to retail trade and subgroups by main activity in 2020.

The main areas in demand were identified against the background of statistical data relating to the sectors of employment of companies in the Russian Federation for 2020.

The full list of subgroups with codes contains one hundred items. The official website also provides the OKVED retail trade 2020 table with interpretation.

| Section G | Wholesale and retail trade |

| Code | Name |

| 47 | Retail trade in goods except category B vehicles |

| 47.1 | Retail trade in stores, without specialization in this type of activity |

| 47.11 | Food, drinks, cigarettes, low-alcohol drinks (beer) |

| 47.11.1 | Frozen food |

| 47.11.2 | Fresh food, drinks, cigarettes |

| 47.11.3 | A large number of food, beverages and other grocery products in stores whose activities in this industry are additional |

| 47.19 | Other trade in stores without specialization (example: stores household appliances or building materials or timber from which food can be purchased, mineral water and so on) |

| 47.19.1 | Availability of food products in stores whose activities in this industry are additional |

| 47.19.2 | Department stores |

| 47.2 | Trade in food products, cigarettes in specialized stores |

| 47.21 | Fruits and vegetables |

| 47.22 | Meat and offal |

| 47.23 | Fish, crayfish, seafood, canned food |

| 47.24 | Bread and all flour products. Includes custom cakes and baked goods |

| 47.25 | Drinks containing alcohol and drinks that do not contain it |

| 47.26 | Cigarettes |

| 47.29 | Eggs, dairy products, oils, cereals, sugar |

| 47.3 | Non-food products, fuel, lubricants and liquids for motorcycles, finishing materials |

| 47.4 | Computers, phones, laptops, personal equipment |

| 47.5 | Household chemicals, clothing, textiles |

| 47.53 | Carpets |

| 47.59 | Furniture |

| 47.6 | Books, newspapers, music, sports equipment, boats, bicycles, tents, toys for children, jewelry |

| 47.7 | Other clothing outside stores |

| 47.72 | Shoes |

| 47.74 | Medical supplies |

| 47.78 | Cosmetics and perfumes, cameras, glasses, souvenirs, gas, weapons |

| 47.79 | Books. Second-use goods |

| 47.8 | Trade in tents, kiosks and other flowers, low-alcohol drinks |

| 47.9 | Via the Internet, at home, using postal services |

| 47.99 | Direct transfer of goods or transfer through agents |

It is worth noting that OKVED for retail trade in non-specialized stores in 2020, that is, OKVED for an additional type of activity, is in greatest demand this year among stores focused on building materials, household chemicals and other items not related to food.

- Capital investments: 800,000 rubles,

- Average monthly revenue: 450,000 rubles,

- Net profit: 65,414 rubles,

- Payback: 12.3 months!

According to a study conducted by ABARUS Market Research, the Russian retail trade market for building materials, compared to the West, is at an early stage of development. At the same time, the annual growth rate is 20%. In 2007, the volume of the retail trade market for household goods and repairs was more than $14 billion in Russia. In 2011, the market volume was about 17 billion dollars, and by 2020 the market volume will be about 30-35 billion dollars. (expert opinion).

About 80-90% of the construction market volume is accounted for by large chain companies (both Russian and foreign), and the remaining part of the market is divided between single stores and small retail chains (regional). Taking into account the fact that on Russian market Several new foreign players are planning to enter, and taking into account plans to expand existing federal chains, the market share of “single stores” will be declining.

In connection with the above, small stores cannot compete with federal retail retailers either in prices or in the range of products offered.

But if you want to start a business in the retail trade segment of building materials, you can try to open a small retail outlet in the “Near-Home” format.

This type of store has the following advantages:

- The opportunity to open a store in an area where federal chains will not enter due to the impossibility of obtaining large turnover.

- A special range of products presented and an individual approach to the buyer.

1. Organization of retail trade in building materials

1.1. Room

The premises in which it is planned to open a retail hardware store in the convenience store format must meet the following criteria:

- Area 30-50 sq.m.

- The premises should be located in a residential area, within walking distance for buyers.

- Lack of other stores selling building materials in the immediate vicinity.

1.2. Equipment

The choice of equipment can be approached quite freely, so to reduce the cost of purchasing equipment, some of the racks and shelves for goods can be made with your own hands, and some of the equipment can be bought used

1.3. Staff

The store must be open 7 days a week, operating hours from 9.00 to 20.00. For these purposes, it is necessary to have 2 sellers on staff. (work in shifts, two after two)

1.4. Assortment

During repairs, it often happens that there is not enough wallpaper glue, the hacksaw blade for metal is broken, there are not enough nails, the glue has disappeared somewhere, the neighbor took the screwdriver and did not return it. The buyer is not interested in going to a construction hypermarket for such small things; he is ready to buy all this close to home, even at a higher price; therefore, all this should be presented in an assortment.

Approximate assortment of the store:

- Consumables for tools

- Assembly adhesive

- Wallpaper glue

- Nails, dowels, bolts, etc.

- Construction tools

- other related products.

For optimal operation, the range of products sold should be about 300 items.

1.5. Suppliers

The choice of suppliers must be made from wholesale companies operating in the region. These companies themselves deliver products to the store; if you work with them for a long time, it is possible to provide a deferred payment.

Replenishment of inventory and assortment must be carried out on a weekly basis.

2. Technical and economic calculations

2.1. Opening capital costs

To maintain assortment and uninterrupted trade inventory should be at least two monthly revenues (at purchase prices), and the optimal balance is 2.5-3 monthly revenues.

2.2. Revenue

The revenue of a small (up to 50 sq.m.) hardware store in the “At Home” format, located in a densely populated residential area, with a well-chosen assortment, and in the absence of competitors in the immediate vicinity, is about 400 -500 rubles. per month.

To calculate payback and profitability, the monthly revenue was taken as 400 thousand rubles.

2.3. Cost price

The markup on products sold is 50-80% depending on the product, for calculations we took an average markup of 60%

2.4. General expenses

2.5. Calculating the profitability of a building materials store

2.6. Payback calculation

3. Organizational issues

3.1. Organizational form

The optimal organizational and legal form is an individual entrepreneur.

3.2. Tax system

A hardware store is a promising type of business with a payback period of 12-15 months. with a profitability of ~20%. The Russian construction market is developing annually at a moderate pace of 7-15%, this is explained by an increase in the number of new real estate commissioned, capital and dacha construction. On the direction of development construction industry government policy has a strong influence and financial condition. During crises, the purchasing power of the population falls, which leads to a decrease in the volume of real estate purchases and a decrease in sales of materials for construction stores. In this article we will look at how to open a building materials store from scratch.

Advantages and disadvantages of opening a hardware store

The main target audience of a hardware store: builders and foremen. Let's look at the key advantages and disadvantages of starting a clothing store.

| Advantages | Flaws |

| High profitability of the business and its payback within 12-15 months. | High competition in this segment due to the high profitability of the niche. ~80% is occupied by chain stores |

| “Hot niche.” High demand for construction materials and equipment | The need to provide a wide range of products |

| Moderate initial investment when opening a franchise store ~900,000 rubles. + consulting support for franchisees | The influence of seasonality on sales volume: reduction by 50-60% in winter. |

About 80% of the entire construction market is divided between large network companies (according to ABARUS Market Research). There is a trend towards a decrease in the number of retail construction and hardware stores and their displacement by chain stores. Small stores cannot provide either a wide range or low prices(as for example in LeroyMerlen), their only competitive advantage may be the proximity of the location to objects under construction, residential complexes, cottage villages, etc. Building materials sell better in the spring and in the period September-October. In summer, sales decrease to 70-80%, and in winter to 50-60%.

How to open a building materials store: main types

To open a hardware store, you need to determine its type and the required initial investment.

| Types of store | Peculiarities |

| Small shops (60-90 m²) | They are engaged in small retail sales. They are characterized by a small, narrowly focused assortment: 100-250 items of goods. To open a store you need ~$9000-14000. |

| Medium-sized stores (200-250 m²) | They offer a wider range: 4000-6000 items. They satisfy the needs of consumers who buy not only the essentials, but also decorative elements and related materials. The opening will cost $40,000-60,000. |

| Supermarkets (from 1000 m²) | Wide range of products: 10,000-15,000 items. In addition to retail space, supermarkets have their own warehouses, which facilitates the demonstration of goods and subsequent delivery to the consumer. Opening costs: ~$250,000-350,000. Investments or additional partners are required. |

| Store-warehouse (small wholesale base) | It has a narrow assortment compared to a supermarket. Items for sale are items that do not require display. Advantages of a warehouse store minimum requirements to finishing the room. Well-known and widely used products are sold. Profit is achieved by increasing sales volume, because The markup on goods is minimal. Opening a warehouse store will require large warehouse space. |

How to choose a store location

To make a choice, you must first evaluate the environment of the future store. Since the store is an offline business, the key success factor will be its close location to new buildings, residential complexes, construction markets, and busy highways. There are no strict requirements for the premises for a hardware store; an important condition is the availability of parking spaces for customers' cars. There is no need for special aesthetic appeal of the room - everything should be extremely functional. The optimal area would be a store >200 m2; smaller stores are not profitable due to the small breadth of assortment. The premises must be provided with ventilation and compliance with fire regulations. To open a small store, it is recommended to have your own premises; if the premises are more than 500 m2, it is more profitable to rent it.

One of the advantages of opening a construction store as a franchise is that it belongs to a network, regular suppliers and a wide range of products, technical and information support for franchisees, debugging of business processes, staff training (communication scripts). The average cost of a franchise is ~350,000 rubles.

Supermarkets and small wholesale centers are usually located outside the city limits, since such premises are difficult to find in the center. A location is chosen with convenient transport links, but in a non-residential area to avoid problems with the fire services. For a super-large facility, it is advisable to provide a railway connection.

Search for partners and suppliers

One of the difficulties of opening a hardware store from scratch is finding and working with suppliers; many suppliers require prepayment for goods and materials. If you establish yourself as a reliable counterparty, you can negotiate preferential delivery terms, delivering goods for sale without prepayment. These conditions release additional cash for business development.

It is more profitable to order some construction materials/equipment from China. To search for Chinese suppliers, you can use large international portals and supplier aggregators: Aliexpress.com, Taobao.com. It is not necessary to know Chinese/English; there are many intermediary companies in the Russian Federation that can deliver them from these sites.

Product range

Without a properly selected assortment, the profitability of a building materials store will be low. A simple strategy would be to copy the range of successful competitors.

- If you are opening a small store that is not a representative of a well-known brand, then focus on the mass buyer. Sell inexpensive tools and materials in a broad range. Despite the low prices, the goods must be of high quality.

- Distributors cannot independently set the cost of goods, because all prices are strictly regulated. The advantages of a distributor are support for large suppliers and manufacturers: provision of benefits and discounts when providing goods.

- Medium and large building materials stores sell goods of different price segments: expensive and cheap. This combination allows you to increase profitability.

If there is not enough demand for a certain product, do not abandon it completely. For trading construction goods The breadth of the assortment is important; many buyers make complex purchases to solve various construction problems.

How to open a hardware store: business registration

To open a hardware store, you must register with the local tax office under one of the organizational and legal forms of doing business: individual entrepreneur (IP) or LLC. The table below shows the main stages of registration, the advantages of the form, and the required list of documents. When registering a business, you must select the type of activity according to the OKVED classification codes. This is an important procedure, approach it responsibly; failure to indicate the type of activity and failure to pay taxes will lead to legal proceedings. OKVED codes for a hardware store:

52.46 – (for a store of paints and varnishes); 52.46.1- “Retail trade in hardware”; 52.46.2 – (for a paint, varnish and enamels store); 52.46.3 – (shop of glazing materials); 52.46.4 – (shop selling equipment for crafts); 52.46.5 – (sanitary equipment store); 52.46.6 – (shop of gardening equipment and tools); 52.46.7 – “Retail trade in construction materials not included in other groups”; 52.46.71 – (timber trade); 52.46.72 – (sale of bricks); 52.46.73 – (sale of metal and non-metallic structures). If you intend to trade through an online store, then the OKVED code is suitable: 52.61.2 – “Retail trade carried out through teleshopping and computer networks (electronic commerce, including the Internet).

| Form of business organization | Benefits of use | Documents for registration |

| IP ( individual entrepreneur) | Used to open a small hardware store (up to 200 m²). Number of personnel 1-2 people |

|

| OOO ( limited liability company) | Used to open a hardware store (>200m²). LLC is more profitable for attracting additional financing/loans, partners and scaling |

In law authorized capital LLC cannot be less than 10,000 rubles! |

The optimal choice of preferential taxation system for a hardware store would be UTII(single tax on imputed income), in order to switch to this system, a municipal law must be adopted on the possibility of applying UTII at the location of the store. There are conditions for the transition to UTII: up to 100 personnel and the cost of fixed assets up to 100 million rubles. The interest rate on UTII is 15%. The advantage of this tax is that it is tied to the physical data of the store: area, number of employees, etc. This is beneficial when opening a small store.

If in your region it is not possible to switch to UTII, then an entrepreneur or organization It is optimal to choose the simplified taxation system (simplified tax system) income minus expenses with an interest rate of 15%.

When registering a business, you must immediately submit an application for the transition to a preferential tax regime (UTII or simplified tax system), otherwise the next opportunity to submit an application will arise only at the end of the current calendar year.

Necessary documents for running a store

Below is a list of all necessary documents for store operation:

- documents from firefighters and SES;

- a copy of the state registration certificate with the signature of the manager and the seal of the enterprise;

- a copy of the lease agreement or certificate of ownership of warehouse and retail premises;

- tax service certificate confirming registration;

- certificate of work schedule signed by the manager;

- document confirming the level of education and qualifications of the manager.

Advertising

For an offline business, location is important - this is the best advertising and the opportunity to get potential customers. If there is no traffic of visitors, then the location of the store may have been poorly chosen. Additional advertising may be the use of Yandex or Google contextual advertising. This allows you to attract target customers to the online store website (or landing page).

Store staff

The main staff of the store are sales consultants. When hiring employees, >3 years of construction experience is required. To reduce search costs through recruiting agencies, you can use free bulletin boards avito.ru, irr.ru or thematic forums. Initially, the seller may be the entrepreneur himself. To increase the number of sales, it is necessary to constantly train staff in sales, develop sales scripts and introduce a system of rewarding the seller when fulfilling the sales plan.

Comparison of wholesale and retail trade

The table below provides a comparison of wholesale and retail trade.

| Wholesale | Retail |

| With wholesale trade, you work with a narrow circle of clients (B2B). Interaction is carried out under long-term contracts - goods are shipped regularly. | In retail, you work with a variety of private push-to-market (B2C) buyers. Usually, buyers cannot evaluate the properties and advantages of materials themselves. You will need personnel who can find out the client's requirements and recommend an acceptable purchase option. |

| The main difficulty is concluding contracts with contractors and businesses on supplies, high responsibility. | The main difficulty is constantly creating traffic of visitors to the store. |

Rating of business success factors

- Store location.

- Seller qualifications. Having a desire to work towards the end result.

- Trust in suppliers of goods, deferred payments and discounts they provide.

- Warehouse and store area.

- Advertising support for the outlet.

- Proper organization of the operation of the retail outlet and the display of goods.

Assessment of the attractiveness of a business by the magazine website

| Business profitability |  (4.0 out of 5) (4.0 out of 5) |

Business attractiveness

|

| Project payback |  (4.0 out of 5) (4.0 out of 5) |

|

| Ease of starting a business |   (3.0 out of 5) (3.0 out of 5)

|

|

| A building materials store requires moderate initial costs ~ 900,000 rubles. (if the store is opened as a franchise). If you open it yourself, the costs will increase by paid stocks of materials and equipment from suppliers and will amount to ~ 2 million rubles. A key factor in the success of the store is its location close to new buildings, residential complexes, and construction sites. Business payback ~12 months. Sales growth is achieved through the introduction of continuous sales training for personnel and a system of incentives and motivation for fulfilling the sales plan. Business requires expert knowledge in installation, construction, finishing work - this will allow you to orient buyers and select products to solve their problems. | ||

OKVED table for retail trade in 2020

OKVED in this industry makes it possible to regulate the activities of official organizations of various sizes: specialized and non-specialized stores, kiosks, stalls, tents, as well as sales at home, handing over goods in person, courier delivery, delivery by mail, etc.

- Classification of organizations, private and individual enterprises and firms of any organizational and legal form according to the type of their activity.

- Assigning a separate code to each type of activity.

- Regulation of this activity.

- Monitoring companies.

- Going international.

- Informing higher authorities.

47 Retail trade, except trade in motor vehicles and motorcycles

- resale (sale without conversion) of new and used goods for personal or household use, or use by shops, department stores, tents, postal trade enterprises, persons delivering goods on a door-to-door basis, traders, consumer cooperatives, etc. d. Retail trade is classified primarily by type of trading enterprise (retail trade in general assortment stores - groups from 47.1 to 47.7, retail trade outside stores - groups from 47.8 to 47.9). Retail trade in general merchandise stores includes: retail sales of used goods (group 47.79). For retail sales in department stores, a further distinction is made between retail sales in specialized stores (groups 47.2 to 47.7) and retail sales in non-specialized stores (group 47.1). The above-mentioned groups are further subdivided according to the range of products sold. Sales of goods not through general stores are classified according to forms of trade, such as retail sales in stalls and markets (group 47.8) and other retail sales not through general stores, such as mail order, door-to-door, vending machines, etc. d. (grouping 47.9). The range of goods in this group is limited to goods usually referred to as consumer goods or retail goods. Therefore, goods not usually sold in retail trade, such as cereal grains, ores, industrial equipment etc. are not included in this group

- retail sale of goods such as personal computers, stationery, paints or wood, although these products may not be suitable for personal or household purposes. Processing of goods traditionally used in trade does not affect the basic characteristics of goods and may include, for example, only their sorting, separating, mixing and packaging

OKVED retail trade 2020

Food products can be sold at retail not only in stores specifically designed for this purpose. Retail outlets with a wide range of products and sales outside stores provide for the possibility of selling food products in compliance with general requirements about consumer information. Such goods are allowed to be packaged, re-sorted, change the composition of batches, and perform other actions that are not transformation.

Why does a company, in fact, need an OKVED code? Firstly, it is necessary from the point of view of collecting statistical data – this makes it easier for Rosstat to know how many organizations in the country are involved in this or that entrepreneurial activity. Secondly, OKVED is necessary for the correct taxation of certain organizations: depending on the type of economic activity, companies use certain taxation systems. That is, a notary office cannot be subject to a single tax on imputed income, and gold mining – be on the simplified tax system.

Retail trade OKVED

Retail sale of goods such as personal computers, office supplies, paint or wood, although these products may not be suitable for personal or household use. Processing of goods traditionally used in trade does not affect the basic characteristics of goods and may include, for example, only their sorting, separating, mixing and packaging

Resale (sale without conversion) of new and used goods for personal or household use, or use by shops, department stores, tents, postal service enterprises, persons delivering goods on a door-to-door basis, traders, consumer cooperatives, etc. . Retail trade is classified primarily by type of trading enterprise (retail trade in general assortment stores - groupings from 47.1 to 47.7, retail trade outside stores - groupings from 47.8 to 47.9). Retail trade in general merchandise stores includes: retail sales of used goods (group 47.79). For retail sales in department stores, a further distinction is made between retail sales in specialized stores (groups 47.2 to 47.7) and retail sales in non-specialized stores (group 47.1). The above-mentioned groups are further subdivided according to the range of products sold. Sales of goods not through general stores are classified according to forms of trade, such as retail sales in stalls and markets (group 47.8) and other retail sales not through general stores, such as mail order, door-to-door, vending machines, etc. d. (grouping 47.9). The range of goods in this group is limited to goods usually referred to as consumer goods or retail goods. Therefore, goods that are not usually sold in retail trade, such as cereal grains, ores, industrial equipment, etc. are not included in this group

OKVED classifier for individual entrepreneurs and LLCs for 2020

- (65.2) Other financial intermediation

- (65.21) Financial leasing

- (65.22) Provision of credit

- And other 65.2X

- (66.0) Insurance

- (66.02) Non-state pension provision

- (67.12) Exchange transactions with stock values

- (67.12) Exchange transactions with stock values Natalya / in

- When filling out an application for registration of an individual entrepreneur or LLC, it is necessary to indicate the codes of the economic activity that the organization will be engaged in. Moreover, there may be several codes (according to the law, the number of indicated OKVED codes is not limited), but it is necessary to indicate the main type of activity by indicating the appropriate code. The main type of activity affects the calculation of the amount of contributions paid to the insurance and pension funds;

- OKVED codes are found in regulatory and legal documents related to the regulation of certain economic activities;

- in the state statistical register, which records types of activities and regulates the development of economic processes;

- in other documents at the state and international level related to maintaining statistics and storing information on types of economic activity.

What are the OKVED codes for individual entrepreneurs in the food retail trade in 2020?

It’s certainly impossible to imagine a specialized grocery store without such a product as bread. It is the most popular among all categories of the population, so it can be found at any food retail outlet. This should include the following subclasses and types of activities provided for by the classifier:

- 47.29.11 – sale of fresh milk and dairy products;

- 47.29.12 – trade in poultry eggs;

- 47.29.21 – sale of animal oils and fats used for food;

- 47.29.22 – sale of oils plant origin, spreads;

- 47.29.31 – sale of flour and pasta;

- 47.29.32 – sale of cereals;

- 47.29.33 – sugar trade;

- 47.29.34 – salt trade;

- 47.29.35 – retail sale of cocoa, coffee, tea and other similar drinks;

- 47.29.36 – sale of homogenized food products, as well as dietary, sports and baby food.

OKVED: retail and wholesale trade

Licensing, tax benefits, and the tariff for contributions for injuries depend on the specified code. Also, new codes are a necessary “requisite” for accounting and tax reporting. At the same time, the legislation does not limit the choice of the number of types of activities. The main rule is the presence of at least one code that will characterize the main type of trade that the company conducts.

Starting from January 1, 2020, tax authorities and companies, including wholesale and retail trade organizations, switched to the new Classifier of Economic Activities OK 029-2014. The directory was approved by Rosstandart by its order dated January 31, 2014 No. 14-Art. True, the codes changed a long time ago, but they were officially allowed to be used only this year.

Retail trade in okved building materials

The latest edition of the classification directory is more detailed. Current OKVED #8212; , trade in building materials in which is located in section G under numbers 51 and 52. Sales wholesale, in-house, through agents and retail are collected in various subgroups. They provide an even more detailed breakdown of the types of products sold. This:

Types of economic functioning of enterprises are grouped by individual characteristics such as belonging to the industry, production methods and others. The OKVED code (trade in construction materials, for example) is assigned in accordance with the Russian codifier of types of economic activity and has at least four digits. The first two are the main group (in this case, “Wholesale and retail sales”), the next are more refined (for example, “Retail sale of paint and varnish products”).

OKVED: retail trade of non-food products

Checks can serve as protection for both the client and the seller. In case of conflict situations (discovered shortage, discrepancy between the price in the check and the stated one), each of the parties keeps evidence of correctness. And in court cases, which arise at the initiative of customers, a check is the only opportunity for a store to prove its case and maintain its image.

45 group includes activities that are related to the sale and repair of cars or motorcycles. 46 and 47 include all activities that are related to sales. The main difference between 46 and 47 (wholesale and retail) is based on the predominance of a particular type of buyer in each group.

05 Aug 2018 1100

B1 in English what level?

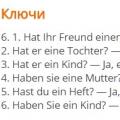

B1 in English what level? Managing verbs in German - German online - Start Deutsch

Managing verbs in German - German online - Start Deutsch Conjugation of the verb haben (to have) in the present tense

Conjugation of the verb haben (to have) in the present tense