What does Article 177 of the Criminal Code mean? Malicious evasion of repayment of accounts payable. By the letter of the law

Evasion of debt repayment is perhaps one of the most serious problems in banking, and the solution to this problem does not lose its relevance. The author proposes to analyze the provisions of Art. 177 of the Criminal Code of the Russian Federation “Malicious evasion of repayment of accounts payable” and eliminate certain misconceptions regarding the application of its norms.The article provides a description of the main elements of the crime and an analysis of law enforcement problems.

Evasion of debt repayment is currently a fairly common phenomenon in Russia. There are many reasons for this situation: the unstable and problematic nature of economic relations, features of mentality, etc. Correcting the situation can be facilitated by increasing the effectiveness of the application of Art. 177 of the Criminal Code of the Russian Federation “Malicious evasion of repayment of accounts payable.”

Now this norm is used extremely rarely1 and is often called “dead”, but there are opportunities for its “reanimation”. Improving the application of Art. 177 of the Criminal Code of the Russian Federation became most relevant after February 2008, when the inquiry under this article was transferred to the Federal Bailiff Service.

To better understand the problem, we suggest considering and debunking the myths surrounding Art. 177 of the Criminal Code of the Russian Federation and interfering with its application.

Possibilities of criminal prosecution for malicious evasion of repayment of accounts payable Let's start with myths, i.e. common misconceptions about the possibility of criminal prosecution for malicious evasion of repayment of accounts payable. As communication with victims and law enforcement officers shows, the following myths are currently widespread.

1. There are no opportunities for effective application Art. 177 of the Criminal Code of the Russian Federation.

We consider this statement to be a myth simply because a similar article. 157 of the Criminal Code of the Russian Federation “Malicious evasion of payment of funds for the maintenance of children or disabled parents” is used in some years 200 (!!!) times more often. Practice also shows that in some courts, even within one year, several sentences are passed under the article in question, which amounts to more than 10% of total number similar sentences in Russia.

2. Article 177 of the Criminal Code of the Russian Federation deals only with debt on loans (creditor - that means on credits, loans).

This misconception arose due to a literal understanding of the text and, in some cases, inattention to this composition on the part of the authors of textbooks and commentaries. The article mentions accounts payable, which covers all types of debt and differs from accounts receivable, i.e. rights to demand payment of certain amounts. Accordingly, any debt is considered payable (except for tax and other debts, which are discussed in other articles of the Criminal Code). Evasion of payment of debt under a supply agreement, compensation for damage caused, etc. may also qualify under Art. 177 of the Criminal Code of the Russian Federation.

3. From criminal liability under Art. 177 of the Criminal Code of the Russian Federation is easy to get rid of (partial payment of the debt is sufficient, etc.).

Such ideas are associated with analogies with Art. 159 of the Criminal Code of the Russian Federation “Fraud”, in which the absence of intent to steal is sometimes indicated by partial payment of a loan received or repayment of a debt. Malicious evasion is not theft and such actions will not help an unscrupulous debtor in any way if he is hiding property worth more than 250 thousand rubles from collection - even if he were to pay significant amounts.

4. With the correct application of Art. 177 of the Criminal Code of the Russian Federation there will be a lot of sentences.

This is also a misconception, because... This composition is most often applicable in cases where the debtor has the opportunity to pay the debt, but for subjective reasons he does not do so. If the threat of criminal liability is already real, very often the debt is repaid and released from criminal liability in connection with reconciliation with the victim (Article 76 of the Criminal Code of the Russian Federation). It can be noted that the peculiarities of accounting for the successful movement of criminal cases lead to the fact that reconciliation most often occurs at the stage of judicial review, rather than inquiry.

Main elements of the crime Without dwelling in detail on the object of the crime, because it does not have much practical value; let us turn to the characteristics of the objective side.

Article 177 of the Criminal Code of the Russian Federation establishes criminal liability for malicious evasion of large-scale debt repayment after a court decision has entered into legal force. The composition is formal, i.e. malicious evasion actions are sufficient. These actions must be related to large amounts of debt, i.e. more than 250 thousand rubles. In determining the amount of debt, it is necessary to focus on the judicial act by which it was confirmed. In this case, the amounts of debt under different judicial acts can be summed up if the subject and the victim are the same. A judicial act is most often a decision of a court of general jurisdiction or an arbitration court, but the debt can also be confirmed by other judicial acts, for example, a court order.

The objective side, from our point of view, is expressed in the form of action - evasion. At the same time, for convenience of application, evasion can be considered identical to concealment of property, which may be foreclosed upon by a court decision. There is a point of view that evasion can be in the form of inaction, but we believe that this approach does not take into account the possibility of enforcement of court decisions, within which the Federal Bailiff Service has broad powers sufficient to overcome evasion in the form of simple inaction.

Considering evasion in the form of inaction possible, we seem to justify the possible ineffective work of bailiffs who do not take all necessary measures to collect the debt.

Concealing property (cash, real estate, etc.) to evade debt repayment is of two types:

- legal;

- physical.

In our practice, there was a case when an individual entrepreneur (IP) evaded paying off a debt by concluding a fictitious agreement with a person without specific place residence, for which the acquisition of individual entrepreneur status was organized by one law firm, which then used the data of this person for illegal purposes. A frequent case of legal evasion is the receipt of wages, which are not reflected in official reports (note that the so-called “black” wages can be summed up over a certain period so that there is an amount necessary for criminal prosecution).

Varieties of legal concealment are constantly evolving, for example, options have emerged with the conclusion of marriage contracts or alimony agreements, according to which all assets go to one spouse, and all debts to the other, although actual marital relations continue even after divorce.

Physical concealment is manifested in the fact that any property (most often movable) is hidden in such a way that the creditor and bailiffs do not know about its location. Physical concealment is less common than legal concealment because it is more complex and does not apply to all types of property.

We emphasize that if a person does not have the ability to repay a debt that is more than 250 thousand rubles, criminal liability under Art. 177 of the Criminal Code of the Russian Federation, from our point of view, is impossible, since this would be a kind of objective imputation. Article 177 of the Criminal Code of the Russian Federation refers to actions after the debt has arisen and does not cover actions to obtain funds.

We will separately dwell on cases where actions to legally conceal property are carried out before a court decision is made or it enters into legal force.

Naturally, an unscrupulous debtor, realizing that the court's decision will not be in his favor, often does not wait for its rendering, but hides the property in advance. We believe that after the judicial act enters into legal force in such cases, qualification under Art. 177 of the Criminal Code of the Russian Federation, since the debtor, while actually owning, using and disposing of the property, “de jure” has no relation to it and makes it impossible to enforce the court decision. In these cases, a situation similar to ongoing crimes that are associated with failure to fulfill duties (for example, escape, evasion of military service, etc.) results.

The sign of maliciousness requires special attention, which, according to practitioners, often complicates qualification under Art. 177 of the Criminal Code of the Russian Federation.

We believe that anger as an evaluative concept can be defined in various ways. For example, an analogy with Art. 157 of the Criminal Code of the Russian Federation “Malicious evasion of payment of funds for the maintenance of children or disabled parents.” In the practice of bringing to criminal liability for evading the payment of alimony, maliciousness is defined as failure to fulfill the obligation to pay, if possible, after two warnings from the bailiff.

However, we can talk about malicious evasion of repayment of accounts payable in cases where there were no two warnings from the bailiff. In practice, a situation may arise when the debtor enters into a conspiracy with the bailiff and, accordingly, the necessary warnings are missing.

There are quite a lot of examples when the evaluative concept of “malice” is applicable.

Main problems of law enforcement The evaluative nature of this characteristic is also evidenced by the different understanding of maliciousness in different legal acts. For example, malicious failure to pay a fine in accordance with the Criminal Code of the Russian Federation is considered failure to pay for unexcusable reasons on the last day of the deadline for fulfilling this obligation. In general, it is advisable to associate maliciousness with the debtor’s commission of special actions to conceal his property (concluding contracts, bribing bailiffs, etc.).

Subjective signs of a crime under Art. 177 of the Criminal Code of the Russian Federation, cause less controversy than objective ones. There must be direct intent to evade debt repayment. We emphasize that direct intent is quite easily proven in the case of legal concealment of property, because registration of imaginary transactions (signing of contracts, acts, etc.) clearly indicates awareness of the public danger of one’s actions and the desire to commit them. At the same time, a technique often used to conceal fraud is when the debt is paid little by little and this is considered evidence of the absence of intent to commit a crime, in in this case does not help if property worth more than 250 thousand rubles is hidden.

The subject of a crime under Art. 177 of the Criminal Code of the Russian Federation can be as a leader legal entity, so is the citizen. We specifically note that for qualification under Art. 177 of the Criminal Code of the Russian Federation, it is necessary to remember the possibility of bringing to justice the actual, and not the nominal, head of the organization. Bringing actual managers to justice has been developed in detail for tax crimes2. Accordingly, in cases where the actual head of a debtor organization leaves it and creates a new organization, where he becomes the actual head and extracts income that is not used to pay off the debt of the original organization, the question of criminal liability under Art. 177 of the Criminal Code of the Russian Federation.

Unfortunately, in publications under Art. 177 of the Criminal Code of the Russian Federation rarely considers the possibility of complicity in this crime and attempt on it. From our point of view, very often when evading debt repayment there is a distribution of roles: accomplices become persons who sign fictitious agreements under which they allegedly receive property, etc. Accordingly, when investigating evasion of debt repayment, one must pay attention to the qualifications of the actions of not only the performer, but also other accomplices.

It is important to pay attention to the possibility of assassination attempt under Art. 177 of the Criminal Code of the Russian Federation. Let’s imagine a situation where a debtor, who does not want money to be withheld from his wages to pay off the debt, agrees with the employer that wages (in the amount of, for example, 100 thousand rubles per month) will be paid unofficially. Let's assume that this fact is revealed after 2 months and it turns out that the amount of evasion required for qualification under Art. 177 of the Criminal Code of the Russian Federation, not yet, but actions aimed at evasion on a large scale have not been completed for reasons beyond the control of the person. We believe that in such cases the actions of the perpetrator can be qualified as an attempt.

Thus, Art. 177 of the Criminal Code of the Russian Federation “Malicious evasion of repayment of accounts payable” can be applied more effectively than at present. The improvement of law enforcement practice should be facilitated by scientific advice and public support.

1 In 2006, only 15 sentences were passed in such cases.

2 Paragraph 7 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 28, 2006 No. 64 “On the practice of courts’ application of criminal legislation on liability for tax crimes.”

Often people take out a loan in anticipation of some pleasant purchases: new apartments, cars, renovations or something else large and significant. Some people, of course, take out loans for vacations, celebrations, or even for a new laptop or phone. And few people think that you can go to jail for taking out a loan. Yes, yes, all these collectors, calls from banks are one thing, but prison is completely different. Let's figure out what needs to be done to go to jail for a loan and what to do to ensure that this never happens.

To jail for a loan? Easily! What is this wonderful article 177 of the Criminal Code of the Russian Federation?

People who take out a loan, in the vast majority of cases, understand perfectly well that if they do not repay it, then any problems may arise: calls from banks, from collectors, fines and penalties, courts and meetings with bailiffs, but few people know about the presence of criminal liability for evasion of loan repayments.

It's true that it's not all that scary. Criminal liability is provided for malicious evasion of payment of accounts payable by citizens and heads of organizations. The amount must be from 2,250,000 rubles, and a court decision must enter into force in the credit dispute. All this is regulated by Article 177 of the Criminal Code of the Russian Federation. And let's figure out what malicious evasion of accounts payable is and how not to fall under this definition.

Article 177 Malicious evasion of repayment of accounts payable

What is malicious evasion of repayment of accounts payable? Who can the court consider a malicious defaulter on a loan?

- A person who has the financial ability to fully or partially repay loan obligations, but knowingly and intentionally does not take action to repay the loans. Example: Vasya has a suitcase of money at home, which the creditor’s representatives, the court and the bailiffs know about, but Vasya is in no hurry to take the suitcase of money to pay off the debt. Vasya is going to go to Cuba and spend them there.

- A person who fictitiously transfers his property or money to other persons in order to create the appearance of its absence. Example: Petya could have sold his cars and paid off his loan debt, but he sold his one-year-old Porsche Cayenne to his mother-in-law at a price much lower than the market average, but continues to drive it personally on weekdays. On weekends, Petya rides in a BMW 6 Series convertible, which was also recently sold to a close friend for some suspiciously low price, and as luck would have it, no one saw how the money was transferred for both cars.

- The person provided knowingly false and fictitious information about damage or theft of his own property to bailiffs, the court and the creditor. Example: Gennady is in grief. He has to wear a cheap Chinese copy of an expensive Swiss watch from a very famous watch company, because just last week someone stole an expensive collection of Swiss watches from his apartment, which Gennady just wanted to use to repay an unpaid loan. And Gennady is not at all embarrassed that no traces of a break-in were found in the apartment, and his “Chinese copy” cannot be distinguished from the original even by a representative of a watch brand.

- The person hides sources of income that could cover the loan debt. Example: Mikhail does not officially work anywhere, but he drives expensive foreign cars, is always dressed in Gucci and constantly posts about social media photos from expensive clubs and restaurants surrounded by lovely ladies, whose level of social responsibility raises certain questions. Mikhail is also subscribed to all sorts of public pages about successful freelancers, and in many of them he is even listed as an administrator. And no one can still guess where he got the money from...

- A person does not notify bailiffs about a change of place of residence, work and other information that the debtor must report to authorized persons in the presence of open enforcement proceedings against him, and also creates obstacles to the enforcement of a judicial act. Example: last week Ilya threw a lavish party for 200 people about receiving a new position as deputy director in one of the largest Cypriot offshore companies. But he forgot to call the bailiff and the creditor, to whom he has not been able to repay the loan for a phone made of pure gold for 3 years. By the way, Ilya also did not plan to show them a visa for permanent residence in Cyprus.

As for penalties, Article 177 of the Criminal Code of the Russian Federation states that malicious defaulters on a loan can be fined up to 200,000 rubles, assigned compulsory labor for a period of 480 hours, or forced labor for up to 2 years, as well as arrested for up to 6 years. months and imprisonment for up to 2 years. As you can see, they can easily go to jail for non-payment of a loan.

Practice of application of Article 177 of the Criminal Code of the Russian Federation “Malicious evasion of repayment of accounts payable”

Many may argue that Article 177 of the Criminal Code of the Russian Federation is a non-working article that is almost never used. I will argue. And argue reasonedly! Yes, this is a much less widespread criminal article than 159 of the Criminal Code of the Russian Federation, but there is quite serious judicial practice on it.

Sentence No. 1-13/2017 1-203/2016 dated April 4, 2017 in case No. 1-13/2017 of the Tver City Court, in which citizen R. had a debt in the amount of 1,700,000 rubles, interest for failure to fulfill a monetary obligation for the principal amount of the debt in the amount of 680,000 rubles, interest for the use of other people's in cash in the amount of 15,584 rubles, the cost of paying the state duty in the amount of 20,177 rubles, the amount of costs incurred related to the consideration of the case in the amount of 12,000 rubles, and a total debt of 2,427,761 rubles. As you can see, our hero has gone quite a bit beyond the border at which criminal liability begins. The court imposed a sentence of 300 hours of compulsory labor.

Also, on September 12, 2017, the Anapa District Court of the Krasnodar Territory sentenced Mr. Kh., who had a total debt for unjust enrichment in the amount of 5,254,338 rubles, to 250 hours of compulsory labor.

By verdict No. 1-293/2018 of October 30, 2018, in case No. 1-293/2018 of the Cherkessk City Court, citizen K. was sentenced to a fine of 10,000 rubles for a debt of 3,163,335 rubles.

I analyzed several dozen court decisions, there were no real terms of imprisonment, but there were sentences to suspended imprisonment, and the most popular punishment under Article 177 of the Criminal Code of the Russian Federation is the assignment of compulsory labor.

How not to pay a loan and not become a malicious defaulter on the loan?

Don't take out a loan. And if they did take it, then...

If there is a financial opportunity to pay debts on a loan, which the court, bailiffs and creditor know about, it is quite difficult to do this. If the debtor had any property, then most likely it will be sold in accordance with the law and transferred to the creditor to pay off the debtor’s loan obligations.

There is an opinion that if you repay a loan debt of several million rubles every month by 500-1000-2000 rubles, then you will not be able to be recognized as a willful defaulter on the loan. This is only true if no one can prove that you have the opportunity to repay the loan with much larger amounts, but you categorically do not want to use it. And if there are such facts, they will be able to prove it, especially if they want to.

What can be recognized as a joyful fact is that for loans for doshirak, the latest iPhone or a fur coat (if we are not talking about the most expensive models, of course) and other nonsense, without which you can’t live here and now, you can be sent to prison, well There’s no way they can... Here you only have the chance to communicate with collectors.

Is it possible to go to jail for debt? When can you end up in jail for non-payment of a loan? Citizens using bank loan products must clearly understand what is meant by malicious evasion of loan repayment, what consequences await him and family members, and what types of punishments can be applied to those who do not want to pay “the bills.”

Based on Art. 177 of the Criminal Code of the Russian Federation, “deviators” may face the initiation of a criminal case for evading repayment of loan debt and even a criminal sentence for non-payment of the loan. In this case, the prosecution will need to provide evidence that the citizen deliberately did not make monthly payments on the loan, although he had the financial ability to do so. That is, the debtor hid his income. Strict punishment is provided for malicious evaders - the maximum term of imprisonment is up to two years in prison.

From this article you will learn:

Is there a prison sentence for debts and malicious evasion of loan payments?

If we refer to Art. 177 of the Criminal Code of the Russian Federation, it spells out fines and punishments provided for citizens and heads of organizations who evade loan repayments in large amounts. This also applies to malicious evasion of payment for securities after the relevant court decision has entered into legal force. In these cases, the following types of punishment are provided:

- Administrative punishment is a fine of 200,000 rubles.

- A monetary penalty in the amount of salary or other income of a citizen convicted of evading payment of accounts payable for a period of up to 18 months.

- Forced labor for up to 24 months.

- Arrest for up to six months.

- Imprisonment for up to two years.

As you can see, according to the Criminal Code of the Russian Federation, prison for debt is quite a threat to malicious defaulters. To initiate criminal proceedings against a citizen-evader, the following is required:

- Availability court decision that the unpaid amount is being recovered from the citizen.

- The draft dodger's accounts payable equals an amount exceeding 1,500,000 rubles.

- Proof of the fact that the defaulter is maliciously avoiding repayment of the loan debt.

Criminal liability for non-payment of a loan:

Here is a quote from the Criminal Code of the Russian Federation:

Article 177. Malicious evasion of repayment of accounts payable. Malicious evasion by the head of an organization or a citizen from repaying accounts payable on a large scale or from paying for securities after the relevant judicial act has entered into legal force.

Punishable by a fine in the amount of up to two hundred thousand rubles, or in the amount of the wages or other income of the convicted person for a period of up to eighteen months, or by compulsory labor for a term of up to four hundred and eighty hours, or by forced labor for a term of up to two years, or by arrest for a term of up to six months, or imprisonment for a period up to two years.

What is malicious evasion of repayment of accounts payable?

The concept of malicious evasion of payment on credit accounts or securities implies, first of all, the direct intent of non-payment by a citizen who has the financial ability to repay the debt. In order for a debtor or head of an organization to be recognized as a willful defaulter, some of the following conditions must be present:

- The citizen deliberately concealed from the bailiff that he had signed a new loan agreement.

- The defaulter had sufficient funds in his accounts to fully or partially repay the loan obligations, but he knowingly (deliberately) did not transfer money to the credit institution.

- A citizen who owns property made transactions to alienate it, but did not use the funds received to repay the debt to the creditor. On the contrary, the draft dodger disposed of the money at his own discretion, used the funds received for other purposes, or simply hid the income received. It is worth paying attention to Art. 446 of the Code of Civil Procedure of the Russian Federation, which contains a list of property owned by the draft dodger, which is an exception for seizure for debts in such situations.

- Citizen engaged entrepreneurial activity, carried out financial and credit operations. In particular: he received financial funds under executed loan agreements, made settlements with these funds with other credit organizations, entered into assignment agreements (that is, assigned the right to claim under debt obligations), acted as a creditor, and the like.

- Provided the bailiff with deliberately false information about the damage and theft of property in his ownership. Misled the executive service regarding the destruction of property in a fire, accident or due to natural disaster.

- Concealed additional sources of income, or misled the bailiff that he had no income or property.

- He used relatives for personal gain, transferring movable property to them for safekeeping.

- Inflicted illegal actions on the creditor.

- He deliberately avoided calling the bailiff, who was enforcing the judicial act. Had unjustifiable reasons for ignoring calls or obstructing the execution of court decisions.

- The citizen deliberately created obstacles to facilitate the collection of loan debt. Without notifying the bailiff, he changed his job or place of residence.

Even taking into account the fact that the debtor, who has accounts payable in the amount of 1.5 million rubles, made small monthly contributions to repay the debt (for example, from 1000-2000 rubles), criminal liability under Art. 177 of the Criminal Code of the Russian Federation cannot be avoided. This will happen if the prosecution presents evidence that the debtor had the financial ability and property to allow him to repay the loan in the prescribed amount, but he deliberately did not comply with the court decision. Despite the fact that the bailiff provided him with information about criminal liability in accordance with Art. 177 of the Criminal Code of the Russian Federation.

Criminal term for non-payment of a loan and a new law on bankruptcy of individuals

Bankruptcy Procedure Regulations individuals will be disclosed in Federal Law No. 476-FZ dated December 29, 2014 - entered into force. The Personal Bankruptcy Law will help citizens who have been unable to cope with debt obligations to relieve the burden of unbearable debt - this will happen, in particular, through the sale of property and debt restructuring through negotiations with creditors. In Art. 213. 28 Federal Law No. 476-FZ there are provisions that after the sale of the debtor’s property, in the event of his being declared bankrupt, in judicial procedure the fulfillment of all obligations to credit institutions will be stopped.

Lawyers assume that citizens will “like” such a relatively simple method of getting rid of a debt trap, and some draft dodgers will think about how to hide income and property from bailiffs for the period until the bankruptcy mechanism is launched. In this case, bankruptcy may take on a fictitious nature and become an attempt to cheat, however, if such a fact is revealed, the debtor will suffer severe punishment provided for in Articles 159, 159.1, 177, 198 of the Criminal Code of the Russian Federation.

In addition, the debtor’s illegal fraudulent actions, in accordance with paragraphs 4 and 5 of Art. 213.29 of the Law on Bankruptcy of Individuals, may be aggravating for the “bankrupt”, since an “opened” fictitious bankruptcy will lead to the fact that debts will not be recognized as repaid, despite the fact that the bankruptcy procedure was carried out.

Such a strict measure can be considered as a preventive one, the task of which is to warn the debtor from attempts to cheat with bankrupt status, that is, realizing the extent of responsibility, if fraud is detected for non-payment of loan obligations, the evader will be forced to abandon illegal actions.

Lawyers note that in practice, most likely, some citizens will still try to avoid full repayment of the debt, being confident that liability can be avoided through bankruptcy. Over time, it will become clear how the measures for insolvent citizens provided for by the new law “On Insolvency (Bankruptcy)” will work in practice.

Malicious evasion of repayment of accounts payable is considered today one of the most current problems in the field of banking. The reasons for this situation are the instability of economic ties, the specificity of the mentality and other factors. The law establishes criminal liability for malicious evasion of repayment of accounts payable. Meanwhile, in practice, the measures established by the standards are applied extremely ineffectively. Responsibility for this act includes Art. 177 of the Criminal Code of the Russian Federation. With comments the norm can be found below.

Composition of the crime

Liability for failure to fulfill financial obligations is established Art. 177 of the Criminal Code of the Russian Federation. New edition the norm retained the description of the general elements of the crime. It is formal. The subject's actions must relate to debt incurred on a large scale. It should be recalled that this is considered an amount greater than 250 thousand rubles. When determining the amount of debt, you need to focus on the court ruling that confirms it.

Objective part

According to Art. 177 of the Criminal Code of the Russian Federation it is expressed in action. For convenience, experts equate it to the concealment of property on which the court has the right to impose a penalty. Meanwhile, a number of experts believe that evasion can also be expressed in inaction. However, opponents of this position point out that this approach does not take into account the possibility of enforcement of a court decision. As part of its activities, the FSSP is endowed with fairly broad powers to overcome evasion expressed in inaction.

Concealment of property

It can be physical or legal. The latter is expressed in the form of concluding imaginary transactions. They mean contracts drawn up “for show”. The participants in such transactions do not intend to create the corresponding consequences. Physical concealment is expressed in the fact that property (usually movable) is hidden so that the bailiffs and the creditor cannot know its location.

Specific qualifications

Responsibility measures established by Art. 177 of the Criminal Code of the Russian Federation, refer to actions taken after obligations arise. The composition does not cover the receipt of funds. Cases of legal concealment of property that occur before the decision is made deserve special attention. sentence. According to Art. 177 of the Criminal Code of the Russian Federation the actions of the subject can be recognized as a crime, since he, while actually owning, disposing of, using the property, has no relation to it “de jure” and creates obstacles to the enforcement of the decision. In this case, a situation arises similar to continuing acts of dereliction of duty.

Maliciousness

This concept is evaluative and can be established according to various criteria. Thus, an analogy with Art. 157. This provision provides for liability for non-payment of alimony. In this case, malice is defined as failure to fulfill an assigned duty, if possible, after receiving 2 warnings from a bailiff. Meanwhile, the last circumstance may be absent. In this case, malice will take place. This situation may be due to the existence of an agreement (conspiracy) between the obligated entity and the bailiff.

Subjective part

It is worth saying that the signs that form it cause much less difficulties than objective criteria. When qualifying a citizen’s actions under Art. 177 of the Criminal Code of the Russian Federation, the presence of intent is mandatory. Its direct form is quite easy to prove in case of legal concealment. This is due to the fact that the execution of imaginary transactions clearly indicates an awareness of the danger of behavioral acts and the desire to commit them. It is worth noting here that the frequently used technique of periodically repaying small amounts does not help if a large amount of evasion is established (more than 250 thousand rubles).

Subject of the crime

This may be the head of an organization or an individual. At the same time, in order to be held accountable under Art. 177 of the Criminal Code of the Russian Federation it is necessary to establish an actual, not a nominal director. The procedure for applying punishment to managers has been developed in detail for tax crimes. In cases where the actual director leaves the organization and creates a new enterprise, then extracts income that is not used to pay off the debt of the original company, he can be held accountable under Article 177.

Complicity and assassination attempt

These forms of committing an act are rarely considered within the framework of qualification. However, according to a number of experts, when evading, a distribution of roles is often acceptable. Subjects who sign fictitious agreements under which property is allegedly transferred to them can act as accomplices. Accordingly, when investigating an act, it is necessary to pay attention to the behavior of not only the direct perpetrator, but also the accomplices. In addition, the likelihood of an attempted crime under the article in question should be taken into account. Let's say a debtor, who does not want the amount to be withheld from his earnings to pay off the obligation, negotiates with his manager about a “salary in an envelope.” For example, for a month it is 100 thousand rubles. Suppose this fact comes to light in 2 months. The amount of unpaid debt will not be large enough for the application of Art. 177. However, the actions in this case were not completed due to circumstances beyond the control of the criminal. In such situations, the subject's behavior can be classified as an attempt.

Conclusion

Art. 177 of the Criminal Code of the Russian Federation can be applied in practice much more effectively than is currently the case. Public and scientific advisory support is needed to remove barriers. In addition, there are quite a lot of myths about the application of the article. For example, there is a fairly common misconception that it is possible to be held accountable under the standard only if there is debt on a loan. This opinion arose in connection with the literal interpretation of the provisions. Meanwhile, the norm covers all types of debts other than receivables. The exception is tax arrears, liability for which is established by other provisions of the Criminal Code.

online registration

Online registration

for a consultation with a lawyer

Privacy Policy

PRIVACY POLICY

This Personal Information Confidentiality Policy (hereinafter referred to as the Policy) applies to all information, without exception, that lawyer Alexander Mikhailovich Raetsky (number in the register of lawyers in Moscow 77/12141, Moscow Bar Association "MOVE", 123308, Moscow, st. Kuusinen, 6 building 3) and/or his proxies(including assistants and trainees) can obtain information about the user while using the website http://site (hereinafter referred to as the Site).

Using the Site, clicking any buttons on the Site, filling out the information fields of the Site for the purpose of sending personal data means the user’s unconditional consent to this Policy and the conditions for processing his personal data and information specified therein. If the Site user does not agree with the terms of this Policy, the user is obliged to immediately leave the Site, refraining from further use of it and sending any personal data that he does not want to provide.

1.1. For the purposes of this Policy, “user personal information” or “user personal data” means:

1.1.1. Personal information that the user provides about himself independently when leaving a request for a call back, requesting a service, using the feedback form or in another process of using the Site.

1.1.2 Data that is automatically transmitted by the Site during its use using software installed on the user’s device, including IP address, cookie information, information about the user’s browser (or other program through which the Site is accessed) , access time, address of the requested page, age, gender and other information.

1.1.3. Data that is provided to the Site for the purpose of providing services and/or providing other values for Site visitors, in accordance with the activities of the Site:

username

user email

user phone number

1.2. This Policy applies only to the site http://site and does not control and is not responsible for third party sites that the user can access through links available on the site http://site. On such sites, other personal information may be collected or requested from the user, and other actions may be taken.

1.3. The Site Administration does not verify the accuracy of the personal information provided by the user and does not exercise control over their legal capacity. The Site Administration assumes that the user provides reliable and sufficient personal information on the issues proposed in the Site forms and keeps this information up to date.

2. Purposes of collecting and processing personal information of users.

2.1. The site collects and stores only those personal data that are necessary to provide services and/or provide other values for visitors to the Site http://site.

2.2. The user's personal information may be used for the following purposes:

2.2.1 Communication with the user, including sending notifications, requests and information regarding the use of the Site, the provision of services, as well as processing requests and applications from the user;

2.2.2 Conducting statistical and other studies based on the data provided.

3. Conditions for processing the user’s personal information and its transfer to third parties.

3.1. The site http://site stores personal information of users in accordance with the internal regulations of specific services.

3.2. Confidentiality of the user's personal information is maintained, except in cases where the user voluntarily provides information about himself for general access to an unlimited number of persons.

3.3. The site has the right to transfer the user’s personal information to third parties in the following cases:

3.3.1. The user expressed his consent to such actions by expressing consent to provide such data;

3.3.2. The transfer is necessary as part of the user’s use of the Site, or to provide a service to the user;

3.3.3. The transfer is provided for by Russian or other applicable legislation within the framework of the procedure established by law;

3.3.4. In order to ensure the possibility of protecting the rights and legitimate interests The Site or third parties in cases where the user violates the User Agreement of the Site.

3.4. When processing personal data of users, the Site Administration is guided by Federal law RF “On personal data”.

4. Change by the user of personal information.

4.1. The user can at any time change (update, supplement) the personal information provided by him or her part, as well as its confidentiality parameters, by sending an application to the site Administration at email: info@site.

4.2. The user may at any time withdraw his consent to the processing of personal data by sending an application to the site Administration by e-mail: info@site.

5. Measures taken to protect users' personal information.

5.1. The site administration takes necessary and sufficient organizational and technical measures to protect the user’s personal information from unauthorized or accidental access, modification, blocking, copying, distribution, as well as from other unlawful actions of third parties with it.

6. Changes to the Privacy Policy. Applicable Law.

6.1. The site administration has the right to make changes to this Privacy Policy. When changes are made to the current edition, the date is indicated latest update. The new version of the Policy comes into force from the moment it is posted, unless otherwise provided by the new version of the Policy.

6.2. This Policy and the relationship between the user and the Site arising in connection with the application of the Privacy Policy are subject to the law of the Russian Federation.

7. Feedback. Questions and suggestions.

7.1. All suggestions or questions regarding this Policy should be sent to the site administration by email: info@site.

Order a call

Request a call

Leave us your phone number, we will contact you and answer all your questions.

I'm waiting for a call

Privacy Policy

User Agreement

Nature calendars series “The world around us”

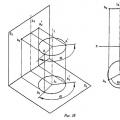

Nature calendars series “The world around us” Methods for converting a complex drawing Method for replacing projection planes

Methods for converting a complex drawing Method for replacing projection planes Why do you dream about a closet - interpretation of sleep

Why do you dream about a closet - interpretation of sleep